In any relationship, when one party changes dramatically the other must change too, or risk a bad breakup. It’s no different with utilities and their customers. Gone are the days when utilities functioned as virtual monopolies and customers were known in purely functional terms as “ratepayers.”

Utility Customers Are Changing

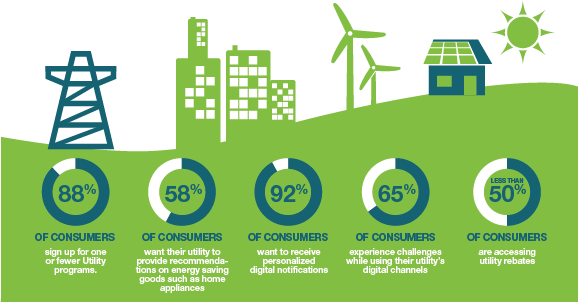

Customers have higher expectations than ever before. According to a recent study by Accenture, more than half (58%) want their utility to provide them with recommendations and ideas for energy savings. And nearly all (92%) want to receive personalized digital notifications. After all, they are in frequent communication with the other companies they do business with through mobile and other devices. They expect to hear from their utilities in the same way.

Utility customers also have more options to take control of their energy usage. Today, there are plenty of companies competing with utilities by providing energy-related products and services. Already, the marketplace is filled with exciting new product options from competitors in a wide range of categories—Google software for measuring home energy usage, the Nest Learning Thermostat, Time Warner Cable’s Security & Energy Package, ADT’s energy management system and more.

And the changes are having a real effect. Judging from the level of consumer participation in utility programs, their connections to their utilities are slipping away. Most consumers don’t have a history of participating in utility programs. And fewer than half are accessing utility rebates.

Building Customer Loyalty

Soon, a highly competitive marketplace filled with energy products and services from dozens of marketers will be the new normal. If a utility does not have options to offer, it will miss out.

Offering customers new energy products and services can help utilities do more than improve customer retention—it can offer new opportunities to increase customer loyalty and build brand equity. An engaging product and service portfolio can spur consumer action to support grid management activities. “In the past, utilities were most concerned about customer satisfaction,” says John Radgowski, Vice President, Solutions and Product Management, Landis+Gyr. “Today, because there are companies that are working to come between utilities and their customers, the focus must go beyond customer satisfaction to customer loyalty.”

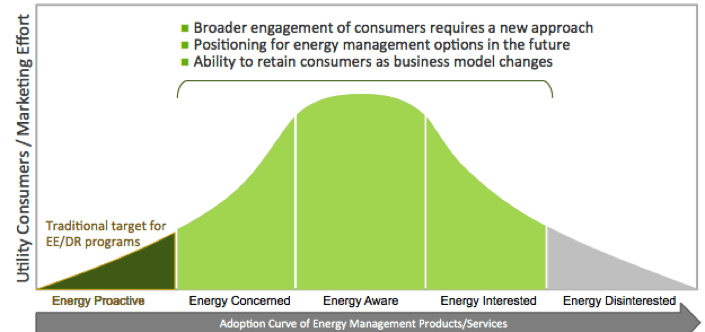

This broader engagement of consumers will require a new approach. According to Radgowski, utilities will need to focus on those customers at the center of the adoption spectrum (see graph).

“The energy proactive customers at the beginning of the spectrum are targets for traditional energy efficiency and demand response programs,” Radgowski says. “Utilities need to focus on the groups in the center—the ‘energy concerned,’ ‘energy aware’ and ‘energy interested.’ It’s more of a challenge to gain incremental engagement from these customers, so the marketing tools and technologies that we use to engage them need to be elevated.”

Deep customer loyalty is a tall order. The good news is that utilities already recognize the importance of the customer relationship to the future of their operations. According to Utility Dive’s “State of the Electric Utility 2015” report, utilities identify the customer relationship as their “second largest future business opportunity.” Yet, even now, utilities are “flat in terms of maturity in leveraging advanced methodologies for next-generation consumer engagement,” according to a recent PennEnergy Survey of 200 energy industry executives.

The Omnichannel Challenge

In addition to driving engagement and loyalty, utilities need to look at how their customers communicate. Customers are constantly connected, through their mobile devices, laptops and desktops, and they expect their experiences with providers to be consistent from device to device. A transaction that begins on a desktop computer should continue seamlessly on a smartphone or tablet. In other words, customers expect an omnichannel experience. Amazon and other Internet giants are already delivering omnichannel experiences (see “Lessons from the Internet” in this issue). Utilities will need to develop an understanding about the many channels that customers are using and their unique capabilities.

Two communication strategies that utilities are beginning to look at more closely are social media and self-service. Social media is growing as a critical customer communication channel, especially for millennials. The PennEnergy survey found that while most utilities have established a social media presence, they are only using the channel for less critical communications such as educational content about energy efficiency rather than for core processes like billing or service requests.

Utilities are also realizing that customers are looking for the kind of enhanced self-service they find at Amazon and other marketers—interfaces that give them fast, specific responses to their needs. Another PennEnergy survey found that innovating customer self-service is a priority for many utilities, many of which are working to launch self-service-oriented smartphone applications. They’re doing this for many reasons, including improved customer satisfaction, as well as improving business processes and brand image and reducing operating costs.

How Behavioral Metrics Are Helping Engage Customers

Many of the country’s leading utilities are already using the information they’re gathering about customer energy consumption from smart grid technologies to improve communications with their customers. Puget Sound Energy (PSE)—an electric and natural gas utility headquartered in Washington state, home to world-class marketers like Amazon, Starbucks and Nordstrom—has long been using meter data to help it understand and communicate effectively with its customers. Using statistical algorithms to evaluate energy usage patterns and customer segmentation analysis, PSE provides energy reports and other personalized messages to customers.

Leveraging expertise in e-commerce strategies and consumer behavior science greatly improves customer communications. “There is value in helping utilities deliver emails with personalized offers to customers,” says Radgowski.

“Our platform enables utilities to translate usage data into messages that consumers are likely to respond to, such as loyalty rewards, social leaderboards to compete against other customers and badges to recognize positive behaviors.”

Utilities are beginning to appreciate that customers do not want to be viewed as just another account number. In today’s world, customers demand more from their service providers, and that includes the increasingly competitive energy industry.

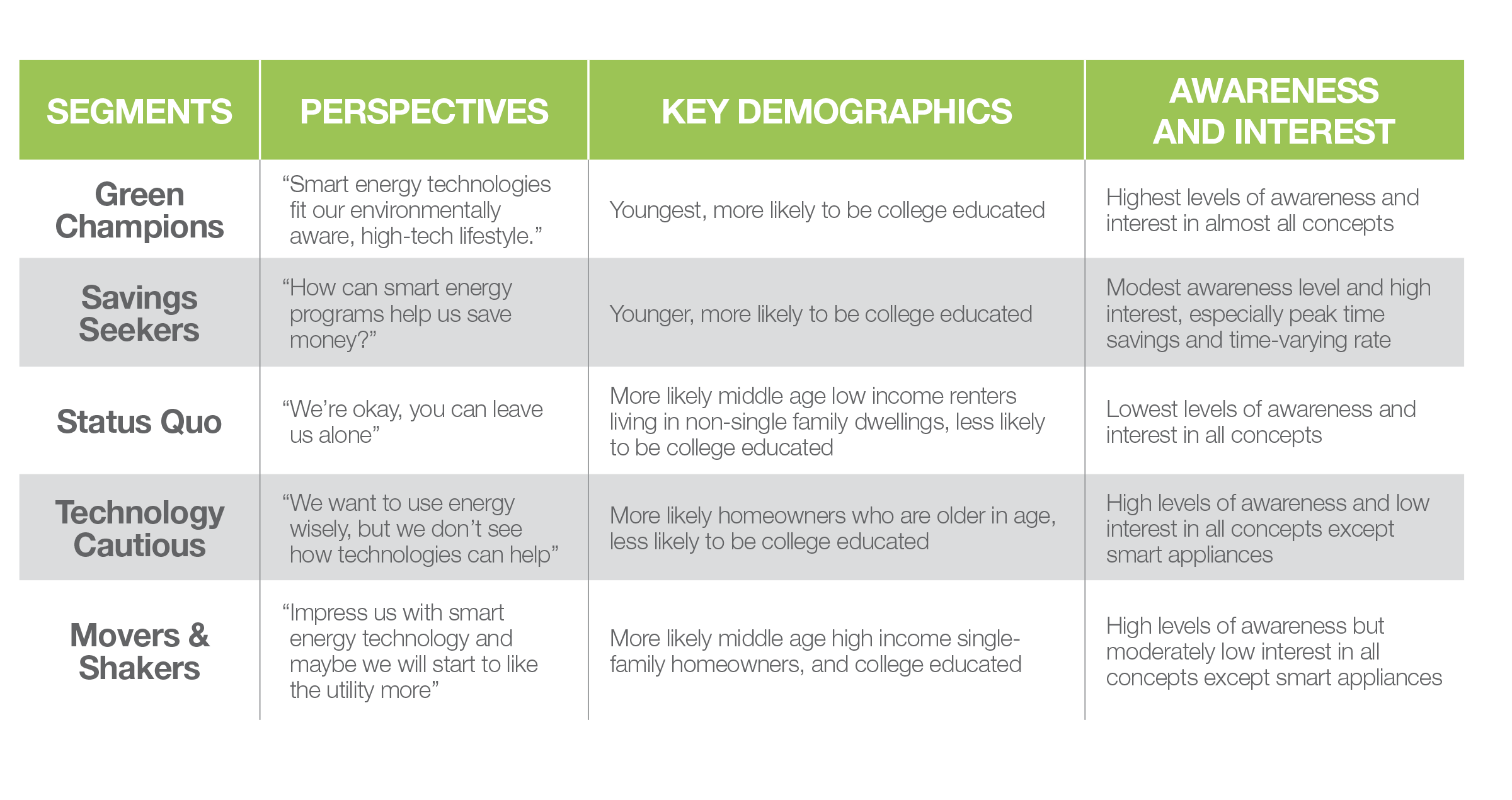

Key Utility Customer Segments—SGCC’s The Empowered Consumer Report

The Smart Grid Consumer Collaborative (SGCC) recently took a close look at consumer preferences for a wide range of smart grid-enabled services and technologies. They classified consumers based on a number of personal characteristics and motivations, with five customer segments (green champions, savings seekers, status quo, technology-cautious, movers and shakers). The study found that:

- Consumer interest in new smart grid-enabled technologies is tied more closely to their consumer segment than their geographic location.

- Consumers need strong evidence (especially customer testimonials) of effectiveness of new services and technologies.

- Smart thermostat programs offer many opportunities for utilities to engage with consumers.

- Utilities can increase consumer participation by offering services with multiple time-varying options.

- The newest technologies (e.g., smart appliances, onsite energy storage) offer expanded opportunities for education and market development.

The study went on to explore ways in which utilities can design future programs offering smart grid technologies, testing options and alternative rate programs.